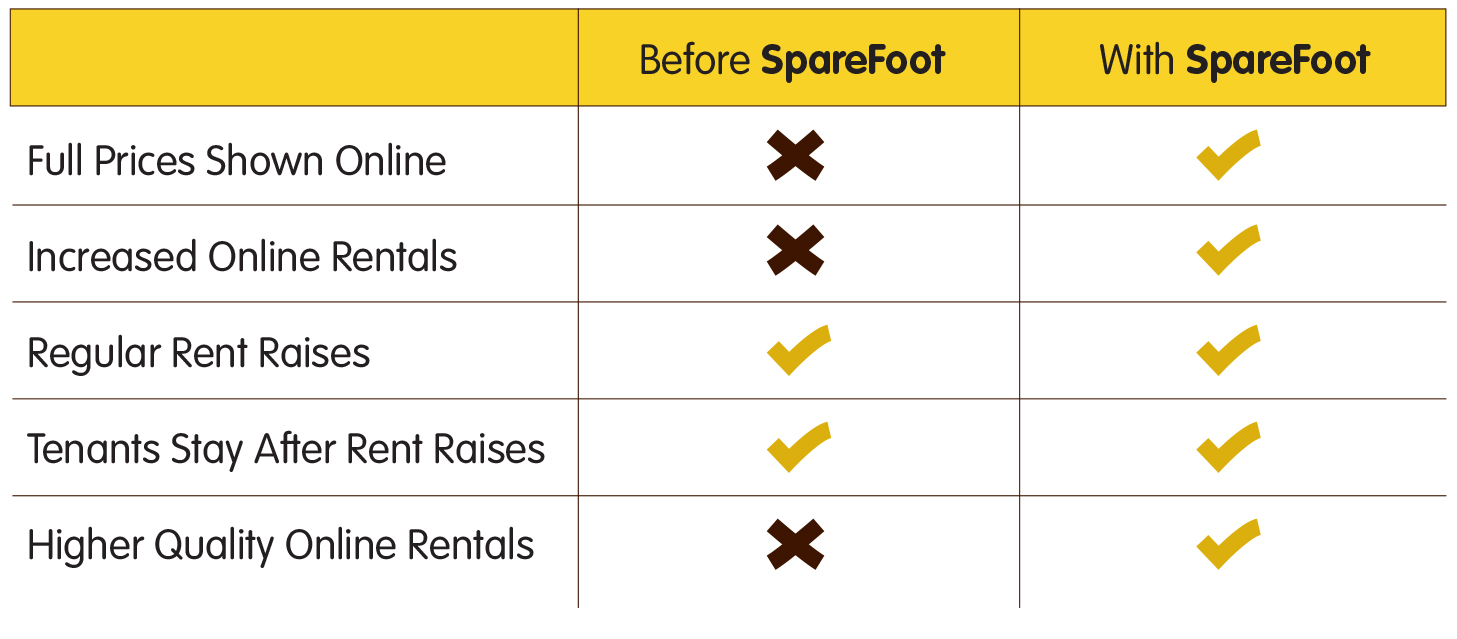

The Jenkins Organization came to SpareFoot for more leads to fill its growing portfolio of storage facilities. Their online customers were typically more price-sensitive than walk-ins. But they’ve found SpareFoot sends a different type of customer—one who is more focused on quality, location and other features TJO boasts. With SpareFoot’s integrated online marketing platform, they’re able to not only charge their highest rates, but continually raise them to outpace larger REITs.

The Goal

The Jenkins Organization wanted to substantially outpace its larger REIT competitors in online customer generation and retention—without lowering prices to do so.

The Results

Reviews on SpareFoot

SpareFoot tenants who moved in

Revenue generated from SpareFoot

Reservations sent by SpareFoot

The Challenge

Many storage companies offer low introductory rates to attract price-sensitive customers on the internet, which has the effect of reducing margins on

an ongoing basis. TJO was already successfully raising rent for existing customers - by up to 10 percent every nine months, depending on the occupancy of the facility - but wanted to get new tenants from the internet in the door at higher rates to begin with.

The Solution

TJO began working with SpareFoot in June 2010. Partnering with SpareFoot has helped TJO increase its occupancy through online exposure on SpareFoot’s extensive partner network. Because SpareFoot uses a pay-for-performance model, TJO only pays for leads that actually convert to rentals and move in to its facilities. SpareFoot makes it easy for TJO to see how much their new tenants cost to acquire, as well as how much money those customers pay TJO over the course of their tenancy.

For starters, they don’t lower their prices. “Contrary to certain beliefs in the marketplace, I am closing 60 percent of my leads on SpareFoot at the highest rental rate we offer instead of a reduced rate,” Manes said. “We add SpareFoot to all of our new properties because I believe it increases my chances of more exposure online at a higher rental rate.” Manes favors a high-low retail merchandising strategy to show a base price crossed out, with a lower price displayed below each price. On his SpareFoot listings, he’s able to experiment with setting larger gaps to charge a higher price for online rentals versus walk-in rentals.

Beyond not lowering prices, TJO can actually raise rents. As an operator focused on revenue management, TJO has found their current customer rent increases result in move-out rates of 7.2 percent—nearly identical to the rate if prices stayed constant, Manes pointed out. This data gives him confidence in the company’s self-storage marketing strategy with SpareFoot and beyond, and helps TJO outpace larger REITs in their areas.

They show full prices on SpareFoot, get new tenants, keep them longer and raise rents regularly over time. Since SpareFoot sends TJO the best possible customers, they are able to significantly outperform much larger operators.

“We don’t look at what the REITs are getting - three to six percent year over year - and say ‘that’s good, that’s what we want.’ No, we want to crush that number,” Manes said. With a little help from SpareFoot, that’s exactly what they’re doing.

Get your free copy

The Client

John Manes is chief operating officer of The Jenkins Organization, a real estate company that owns and manages self-storage properties. TJO has more than 3.5 million square feet of storage space and 21,000+ tenants in Texas, Oklahoma and Louisiana.

The Market

City: Houston, TX

Population: 2,099,451

Total facilities: 500

Number of REIT-owned facilities: 135

The Facility

Owned by: The Jenkins Organization

Years in business: 25

Account: The Jenkins Organization

Number of facilities on SpareFoot: 42

We don’t look at what the REITs are getting - three to six percent year over year - and say ‘that’s good, that’s what we want.’ No, we want to crush that number.

Case studies

-

Independent Operator Now Able to Compete with REITs Online

A self-storage business struggling to compete with the biggest players was able to earn nearly $44k in revenue from new online customers sent by SpareFoot and its national partners.

Read the case study -

Smooth Integration, Smart Tech and Service Drive Storage Company to $1M+ In Rentals

This is how an independent storage operator overcame technology disadvantages in the face of sophisticated REITs to earn more than $1M from 1,431 new customers sent by SpareFoot.

Read the case study -

Online Exposure Helps a Hidden Gem Secure Rentals

Here’s how SpareFoot helped a self-storage facility with low visibility boost its occupancy rate by more than 15%, sending the account 744 new customers.

Read the case study